Gold and Silver Undervalued at Record Highs?

Why This Secular Bull Market Still Has Much Further to Run

It was 3 years ago when I dropped out of my master’s degree in finance, driven by a deep conviction that gold and silver were destined to outperform the archaic and inadequate 60/40 portfolio.

During that time, gold has soared 108%, breaking its all-time highs more than 40 times in 2024 alone. Silver, meanwhile, has skyrocketed 124% over the past 3 years, and now stands tall at 14-year nominal highs.

Naturally, you can imagine the temptation to say “I told you so” is high, especially to those who sneered at your author when he argued the case for gold and silver allocation during his time in academia and the private sector.

Since then, thanks to fellow SMR co-founder, Ronnie Stöferle, your author has been able to carve out a career as a precious metals analyst and now serves as the resident silver specialist at our parent publication, the In Gold We Trust report.

Less sweet, however, is the fact that many investors (perhaps you included) had zero exposure to gold and silver during this period – not because they didn’t want to, but because their financial advisor recommended against it.

Fortunately for this category of investor who has fallen through the cracks of our broken and inefficient system, the following article is here to inform you of one simple thing: It is not too late to invest in gold or silver.

Indeed, despite the fact that we are now firmly in the midst of a secular gold and silver bull market, there are still plenty of historical metrics that suggest both precious metals are relatively undervalued.

Conveniently, the theme of today’s deep dive will be to analyse these metrics. Therefore, whether you’re looking to buy more gold and silver or you missed the boat entirely, this is the article for you.

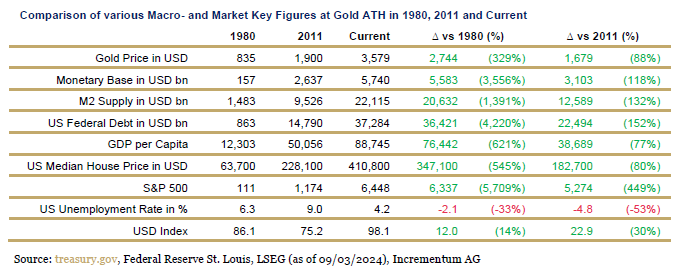

Starting with gold, one of the strongest cases for its undervaluation lies in the monetary base. In 1980, it stood at just USD 157bn. Today, it has expanded to USD 5.74trn, marking a whopping increase of 3,556%.

Meanwhile, gold has “only” produced a 329% increase during the same period, rising from USD 835 in 1980 to highs of USD 3,579 today, as is displayed in the updated table below from the In Gold We Trust report 2025.

By this logic, if gold had merely kept pace with the expansion of the monetary base since 1980, its price today would not sit just under USD 3,600. Rather, the gold price would exceed well over USD 30,000 per ounce.

Incidentally, the same goes for M2 supply, which measures cash, checking, savings, and other liquid deposits, as is differentiated from the monetary base, which strictly covers currency in circulation and central bank reserves.

In 1980, M2 supply was USD 1.48trn, but this has since skyrocketed by 1,391% to USD 22.12trn. Curiously, if gold had grown at the same rate since 1980, it would be sitting pretty around USD 12,000 today.

In fact, gold would be even higher today if we used US federal debt as our barometer. Namely, if we adjust for the federal debt’s 4,220% growth since 1980, gold would be priced at an utterly unprecedented USD 36,000 today.

Heck, even if we more conservatively applied the 152% growth in the US Federal debt since 2011, we’d still be looking at a USD 4,788 gold price, which ironically aligns with our 2030 target at the In Gold We Trust report.

Ultimately, these metrics by no means suggest that gold is about to leap to those lofty heights by tomorrow. However, we do feel they help illustrate the catastrophic failure of fiat currencies as stores of value.

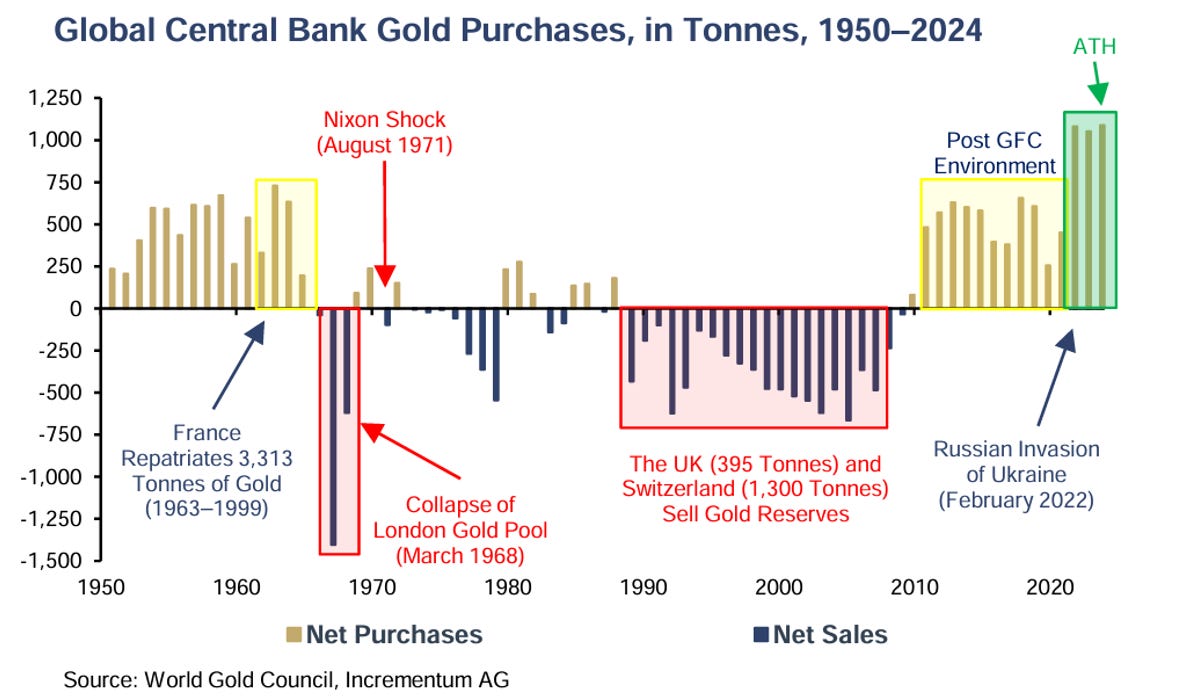

Seemingly, we are not alone in our beliefs that fiat is no longer fit for purpose, as is evidenced by the recent, and sharp, uptick in central bank gold demand, which has danced to the tune of 1,000+ tonnes per year for the last 3.

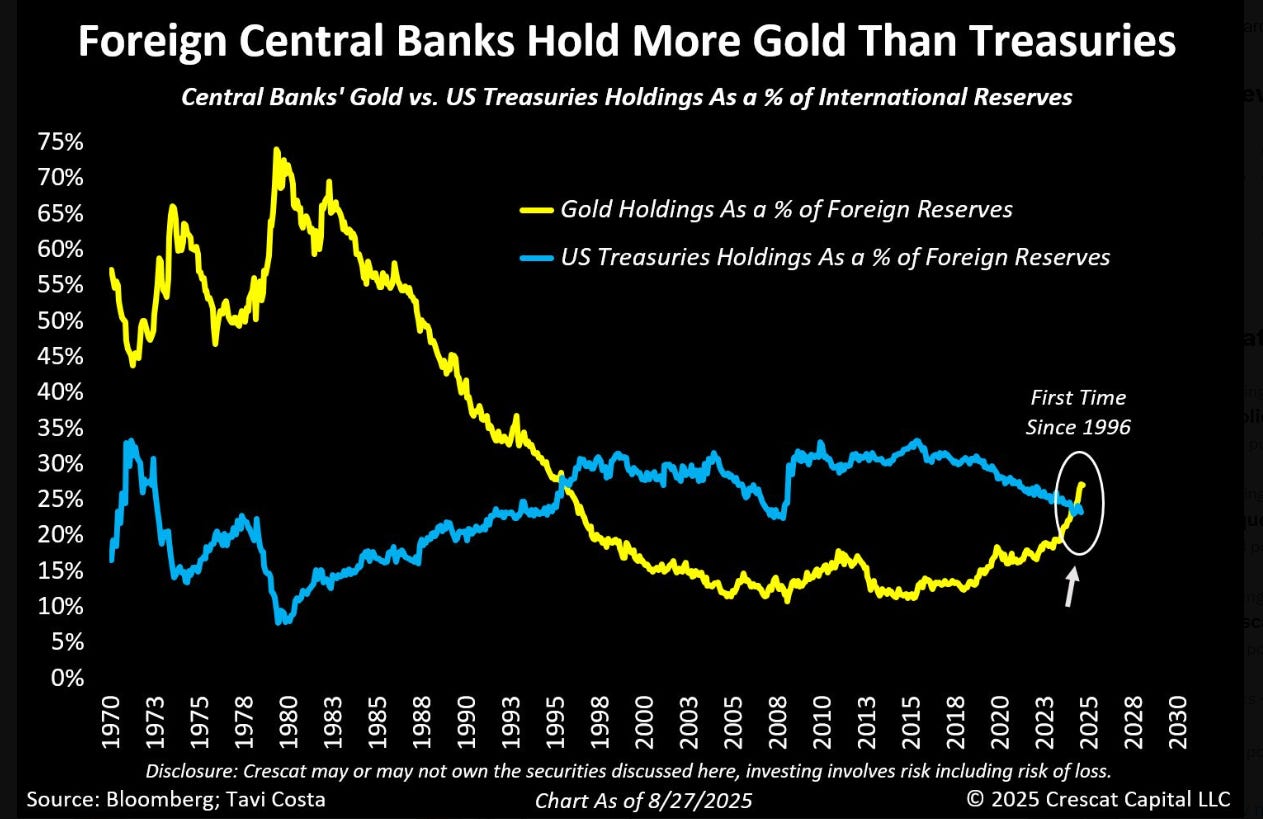

What’s more, foreign central banks’ gold holdings now exceed 30% of international reserves for the first time in 30 years—a clear sign that we now exist in an era we coined as “The New Gold Playbook” in the In Gold We Trust report 2024.

As part of this, Poland’s Central Bank just announced it’s planning to increase gold’s share of its total reserves from the current 20% to 30%. That comes after being the No.1 central bank gold buyer in 2024 (89.5 tonnes).

Similarly, El Salvador just started its gold reserves with a USD 50mn purchase. And to top it all off, Goldman Sachs just forecasted a rise to a 5,000 USD gold price if some USD 333bn flows into gold from US treasuries.

Therefore, in light of this structurally embedded demand, gold appears to have the momentum to go beyond an overtaking of US treasuries, potentially even testing the 75% share of international reserves from its 1980 peak.

With this in mind, we think it’s fair to say that gold is not yet overvalued, despite some “experts” calling the top. Naturally, silver, which remains historically undervalued to gold, looks like a bargain, even at USD 40.

Exacerbated by gold’s relentless ascent, silver’s relative discount to its big brother is best exemplified by the gold/silver ratio, which has historically averaged as low as 2 during Ancient Egyptian times.

Nowadays, of course, silver’s growing role as an industrial metal—combined with its decoupling from the monetary system—makes for a more sobering ratio of 85, down from highs of 100 earlier this year.

Prior to this, a 100 gold/silver ratio “activation point” had only been breached 2 times in modern history. On each occasion, it served as a springboard for silver’s subsequent 4x outperformance of gold in 1991 and 2020.

Nonetheless, investors should note that a mere reversion to the historical mean of the gold/silver ratio since 1970 would translate to a USD 59 silver price at today’s gold price of USD 3,550.

More conservatively, a return to the average gold/silver ratio since 2000 would equate to a USD 52 silver price. More bullishly, the average gold/silver ratio over the last 110 years would command a silver price of USD 68.

As a result, a simple mean reversion could see the white metal rise by a significant 27—66% from its current price around USD 40.92, suggesting further upside exists despite the 45% increase over the last 12 months.

At these levels of value, it’s no wonder that “whales” such as tech founder of Entrata, David Bateman, invested close to USD 1bn in precious metals earlier this year – a purchase that included a huge 12.69 Moz of silver.

Notably, Bateman’s purchase was equal to roughly 1.5% of the global annual supply. As such, one would not be surprised if other investment “whales” continue to follow suit in securing their physical silver in 2025.

Famously, legendary value investor Warren Buffett purchased 25% of the annual silver mine supply (129.7 Moz) from 1997—1998. Had he held on until 2011, he would have clocked an outlandish 900% total return.

Ultimately, whether it be a Buffett- or Bateman-like “whale”, the collective middle class of India, or a notoriously resolute SLV shareholder acting on behalf of an industrial player, the silver price will not discriminate against who fuels its rise from this historical undervaluation.

And with gold itself still relatively undervalued, there’s plenty of time for both precious metals to shine in the spotlight of this secular bull market, especially as we look toward catalysts such as a likely Fed rate cut at the next FOMC meeting on September 17.

Therefore, while some big money has already been made - especially by contrarian investors who stayed true to their convictions in the depths of the past bear market— we strongly believe it’s not too late for new investors to join this gold and silver party—a party that will go down in history as the dawn of the Sound Money Renaissance.